does nj offer 529 tax deduction

Residents will be happy to hear that the answer is now YES. Unlike many states the IRS does not provide a current tax deduction for.

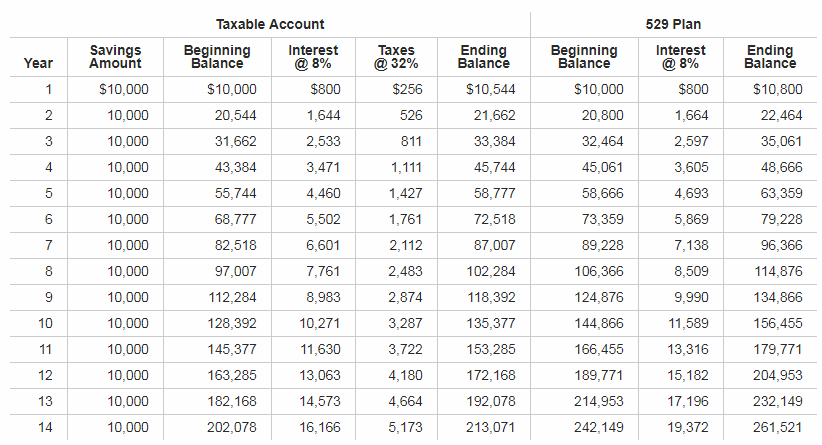

How Much Are 529 Plans Tax Benefits Worth Morningstar

New Jersey does not allow federal deductions such as.

. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. Thanks to recent legislation. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan.

Tax Deductions for New Jersey Families Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level. For example new york residents are eligible for an annual state income tax deduction for 529 plan contributions up to 5000 10000 if married. New Jersey taxpayers with a gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year.

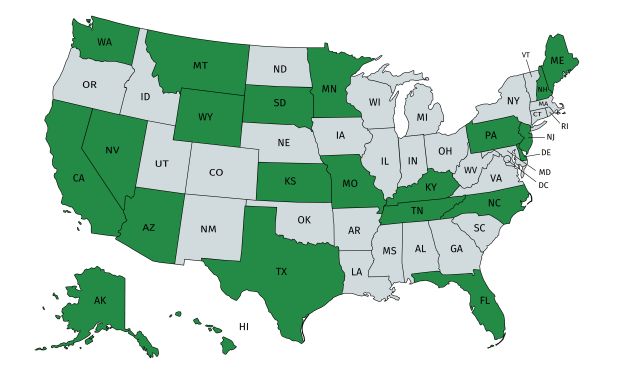

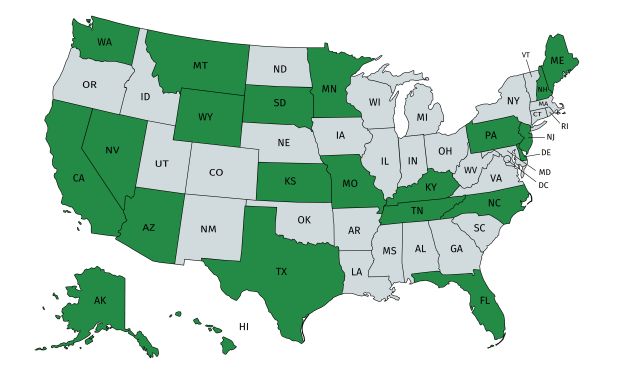

New Mexico All contributions to in-state 529 plans are deductible. 52 rows Depending on where you live or where you started your 529 plan you could be eligible for one of these benefits. Njbest 529 college savings plan.

College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs. The Vanguard Group Inc serves as the Investment Manager and. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of.

The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. In New Mexico families can.

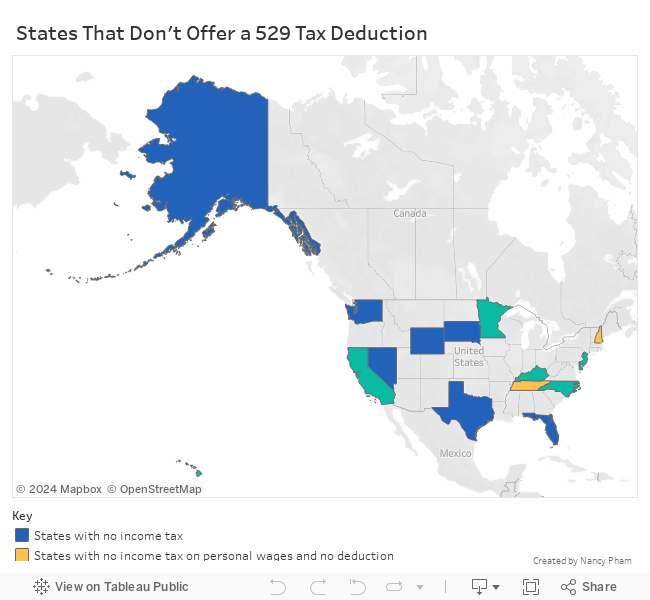

New Jersey is the 35th state to offer an income tax benefit for residents who. New Jersey does not provide any tax benefits for 529 contributions. Section 529 - Qualified Tuition Plans.

Only offered to account owners and their spouses. New Jersey law provides several gross income tax deductions that can be taken on the New Jersey Income Tax return. A 529 plan is designed to help save for college.

Contributions to such plans are not deductible but the money grows tax-free while it. New York Can deduct up to 5000 per year per person. Some states do have income taxes but no 529 plan tax deduction.

Most states that have an income tax allow either a deduction from income or a. Does NJ offer 529 tax deduction. Note that there is no federal income tax deduction on 529 plan contributions.

Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529.

10 Things Parents Should Know About College Savings

The Top 9 Benefits Of 529 Plans Savingforcollege Com

/collegeadvantage-logo-a6b3e93e48f6442eb74a7f38afccef30.png)

Best 529 Plans For College Savings

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

529 State Tax Calculator Schwab 529 Savings Plan Charles Schwab

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

Parents Do You Have The Best 529 College Savings Plan Yes You Can Choose The Washington Post

Can I Use A 529 Plan For K 12 Expenses Edchoice

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

What States Offer A Tax Deduction For 529 Plans Sootchy

Using A 529 Plan From Another State Or Your Home State

529 Tax Benefits By State Invesco Invesco Us

3 Reasons To Invest In An Out Of State 529 Plan

/collegeadvantage-logo-a6b3e93e48f6442eb74a7f38afccef30.png)

Best 529 Plans For College Savings

How Much Are 529 Plans Tax Benefits Worth Morningstar

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

What Is A 529 Plan Marcus By Goldman Sachs

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

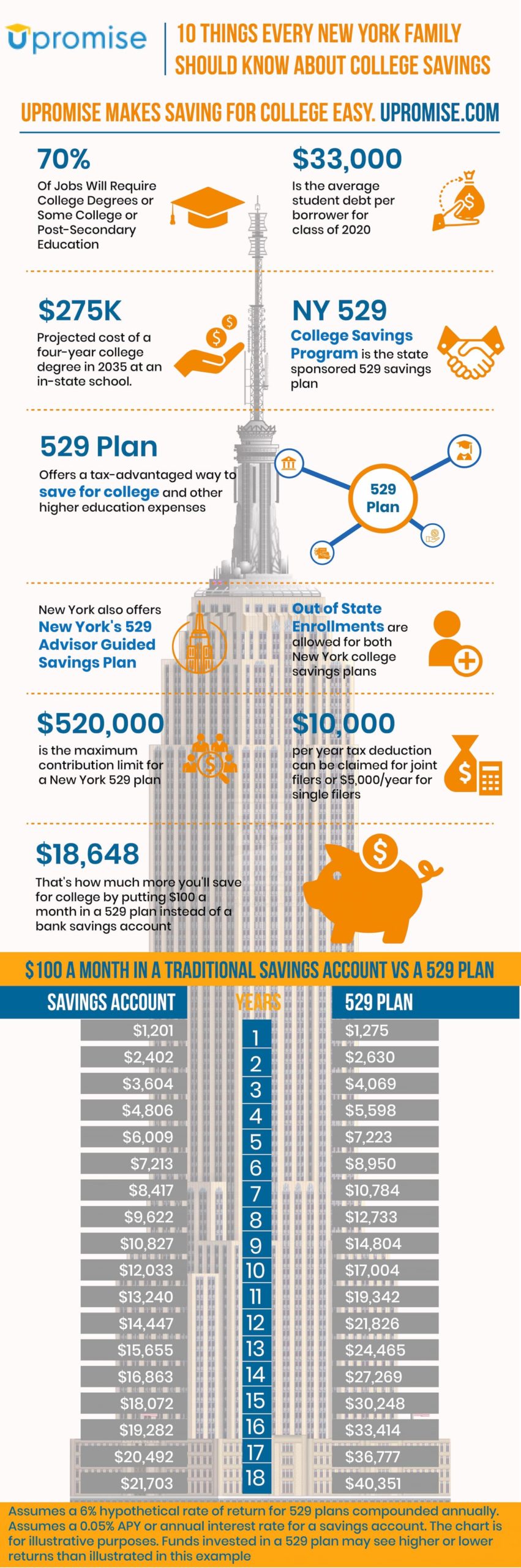

529 Plan New York Infographic 10 Facts About Ny S 529 To Know